NewsVoir

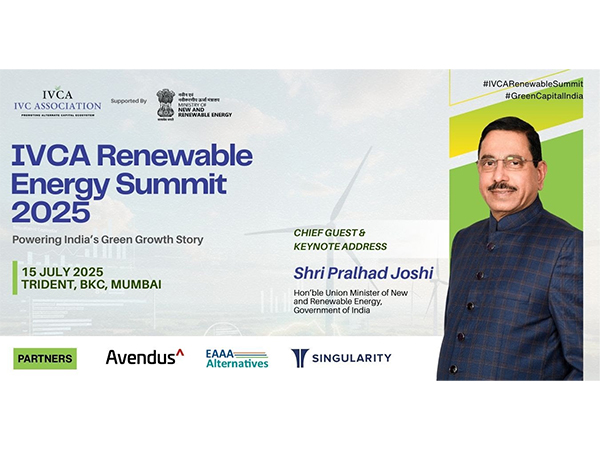

Mumbai (Maharashtra) [India], July 14: India’s clean energy ambitions are set to take centre stage as Shri Pralhad Venkatesh Joshi, Hon’ble Union Minister of New & Renewable Energy, Government of India, will attend the IVCA Renewable Energy Summit 2025 as Chief Guest and deliver the Keynote Address. The event, hosted by the Indian Venture and Alternate Capital Association (IVCA), will take place on July 15 in Mumbai.

Bringing together leaders from across the private equity, venture capital, and alternative investment landscape, the summit is a national platform to galvanise climate-aligned private capital in support of India’s energy transition goals. Organised in collaboration with Avendus, EAAA Alternatives, and Singularity Capital, the event will convene policymakers, institutional investors, family offices, climate-tech entrepreneurs, and financial innovators.

Speaking ahead of the event, Shri Pralhad Joshi said, “India’s clean energy transformation is not just an environmental goal–it is a national mission. From renewable generation to battery storage and green manufacturing, private capital will be key to achieving our 500 GW non-fossil fuel capacity target by 2030. I look forward to addressing the IVCA Renewable Energy Summit and reinforcing the government’s commitment to building a robust, investment-friendly ecosystem for sustainable growth.”

India’s clean energy sector is witnessing unprecedented momentum. In 2024, renewables accounted for 83% of total power sector investments, while non-fossil fuel capacity climbed to 44%, underscoring the country’s strong trajectory toward the 2030 target. India now ranks among the top three countries globally in renewable energy capacity addition.

As the government ramps up efforts to scale solar, wind, storage, and green hydrogen infrastructure, it has placed a renewed emphasis on public-private partnerships. Policy innovations, including viability gap funding for battery storage, incentives for offshore wind development, and grid expansion across new geographies, are designed to enable institutional capital participation at scale. This creates a clear opportunity for Private Equity, Venture Capital, and AIFs to partner in India’s next phase of green growth.

IVCA President Rajat Tandon said, “We are privileged to have Hon’ble Minister Shri Pralhad Joshi join us at the summit. His visionary leadership–whether in scaling renewable energy investments, battery storage, or creating a supportive policy ecosystem–has been instrumental in shaping India’s green growth story. His presence reaffirms the government’s commitment to enabling public-private partnerships that drive sustainable, long-term impact.”

The summit agenda includes sessions on:

* Accelerating clean power finance through innovative models

* Enabling clean mobility, AI, and hydrogen ecosystems through renewables

* Energy storage, grid tech and hybrid systems

* Policy frameworks for capital deployment

The speaker lineup features Dr. Ruchi Chojer, Executive Director, SEBI, and Shri Vishal Kumar Dev, Principal Secretary, Energy, Govt. of Odisha, alongside leaders from top financial institutions, family offices, development banks, and pioneering cleantech startups.

The IVCA Renewable Energy Summit 2025 promises to be a watershed moment in aligning capital with climate goals–highlighting how alternate capital can help unlock India’s full green potential.

The Indian Venture & Alternate Capital IVCA is a not-for-profit, apex industry body promoting the alternate capital industry and fostering a vibrant investing ecosystem in India. IVCA is committed to supporting the ecosystem by facilitating advocacy discussions with the government of India, policymakers, and regulators, resulting in the rise of entrepreneurial activity, innovation, and job creation in India and contributing towards the development of India as a leading fund management hub. IVCA represents 450+ funds with a combined AUM of over $350 Bn. Our members are the most active domestic and global VCs, PEs, funds for infrastructure, real estate, credit funds, limited partners, investment companies, family offices, corporate VCs, and knowledge partners. These funds invest in emerging companies, venture growth, buyout, special situations, distressed assets, and credit and venture debt, among others.

(ADVERTORIAL DISCLAIMER: The above press release has been provided by NewsVoir. ANI will not be responsible in any way for the content of the same)

Disclaimer: This story is auto-generated from a syndicated feed of ANI; only the image & headline may have been reworked by News Services Division of World News Network Inc Ltd and Palghar News and Pune News and World News

HINDI, MARATHI, GUJARATI, TAMIL, TELUGU, BENGALI, KANNADA, ORIYA, PUNJABI, URDU, MALAYALAM

For more details and packages