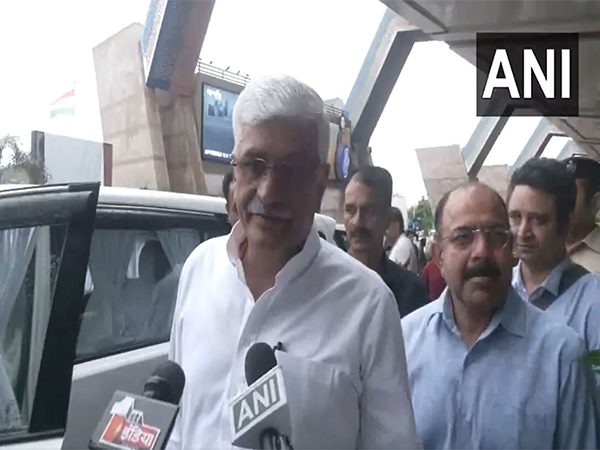

Jaipur (Rajasthan) [India], September 6 (ANI): Union Minister Gajendra Singh Shekhawat on Saturday welcomed the GST Council’s decision to revise tax rates and expressed optimism about the impact of GST reforms on India’s economy.

According to him, the revision of GST slabs and reduction of taxes on essential products will give a significant boost to the Indian economy, propelling it to new heights in the market.

Speaking to the reporters, Gajendra Singh Shekhawat said, “The manner in which India has made progress from an economic point of view, GST slabs have been revised and tax on all products used by a common man have been brought down, it will definitely bring a jump in the Indian economy and provide new heights to the market.”

Earlier on Wednesday, Finance Minister Nirmala Sitharaman announced a sweeping reduction in GST, aimed at providing relief to households, farmers, businesses and the healthcare sector.

The 56th GST council meeting decided to rationalise GST rates to two slabs of 5 per cent and 18 per cent by merging the 12 per cent and 28 per cent rates.

5% slab consists of essential goods and services, including food and kitchen item like butter, ghee, cheese, dairy spreads, pre-packaged namkeens, bhujia, mixtures, and utensils; agricultural equipment like drip irrigation systems, sprinklers, bio-pesticides, micronutrients, soil preparation machines, harvesting tools, tractors, and tractor tires; handicrafts and small industries like sewing machines and their parts and health and wellness like medical equipment and diagnostic kits.

While the 18% slab consists of a standard rate for most goods and services, including automobiles such as small cars and motorcycles (up to 350cc), consumer goods like electronic items, household goods, and some professional services, a uniform 18% rate applies to all auto parts.

Additionally, there is also a 40 per cent slab for luxury and sin goods, including tobacco and pan Masala, products like cigarettes, bidis, and aerated sugary beverages and on luxury vehicles, high-end motorcycles above 350cc, yachts, and helicopters.

Moreover, some essential services and educational items are fully exempted from GST, including individual health, family floater and life insurance, no GST on health and life insurance premiums and education and healthcare, like certain services related to education and healthcare are GST-exempt. (ANI)

Disclaimer: This story is auto-generated from a syndicated feed of ANI; only the image & headline may have been reworked by News Services Division of World News Network Inc Ltd and Palghar News and Pune News and World News

HINDI, MARATHI, GUJARATI, TAMIL, TELUGU, BENGALI, KANNADA, ORIYA, PUNJABI, URDU, MALAYALAM

For more details and packages